A stock represents an investment in a firm. Stocks are traded on public markets, and anybody can buy and sell them, unlike private equity investments, which are normally only open to accredited investors.

Let’s discuss the concept of stock, the mechanics of stock buying, and the potential returns for stock buyers.

Table of Contents

What is a stock?

To own a portion of a corporation, you can purchase stock, sometimes called equity. A share is a fractional ownership interest in a corporation acquired through the purchase of stock.

With stock ownership comes the expectation of future financial gain for the investor. Owners of the company’s stock get a cut of the earnings whenever the business does well.

When a company fails to meet expectations or experiences a decline, shareholders should also expect their returns to be reduced. And if the company goes bankrupt, the value of the stockholder’s investment could plummet to nothing.

How does the stock market operate?

When issuing stock, a company has the option of doing it either privately or publicly. Publicly traded stocks, such as those found on the New York Stock Exchange or the Nasdaq, do not require accredited investors to meet the same strict requirements as private shares.

Many privately held businesses decide to “go public” in order to fund growth strategies like the introduction of new goods or the expansion of existing ones. They achieve this through IPOs, where an investment bank normally determines the share price, and the company is expected to comply with SEC financial transparency rules. Supply and demand determine the stock’s price when the IPO is issued and trading begins.

Tips on the Stock Market and Investing

To trade publicly traded equities, investors must create an account with a stockbroker. The number of commission-free stock brokers who also facilitate the purchase of fractional shares has increased dramatically in recent years.

Investors can rapidly diversify their stock holdings by purchasing stock funds (exchange-traded funds or mutual funds). While some funds are actively managed, others simply replicate the performance of market benchmarks like the S&P 500.

“Accurate stock selecting is a time-consuming task. Therefore, I recommend that [investors] purchase an index or exchange-traded fund (ETF) tracking the S&P 500 (such as VOO) or another relevant market segment, “The CIO of S&J Private Equity Shanka Jayasinha adds.

Why do stock investments yield profits?

Capital gains and dividends are the two main ways for shareholders to make money.

Gains from the sale of capital assets are known as capital gains. Gains of this sort result from a sale at a higher price than was first invested.

Payments made to shareholders regularly are called dividends. Dividend payments can be made at any interval the corporation chooses, but quarterly payments are the norm.

Stock Investing vs Stock Trading

Unlike buy-and-hold investors, active traders aim to profit from little changes in stock price. Investors may be more concerned with the company’s long-term viability, and traders place greater weight on recent developments and technical analysis.

Trading can provide faster returns than investing, but only if you dedicate the time and effort necessary to study and manage deals. Still, you should invest if you want your stock portfolio to generate money while you sleep. In addition, if you’re thinking about trading as a hobby, it’s vital that you carefully consider your trade plan before entering any position and that you maintain that plan no matter what.

Read Also: Unblocked 66: Access all your favorite games

Different Stock Categories

There is a wide number of categories that can be applied to stocks. Below, we’ve summarised the key distinctions between some of the most common varieties.

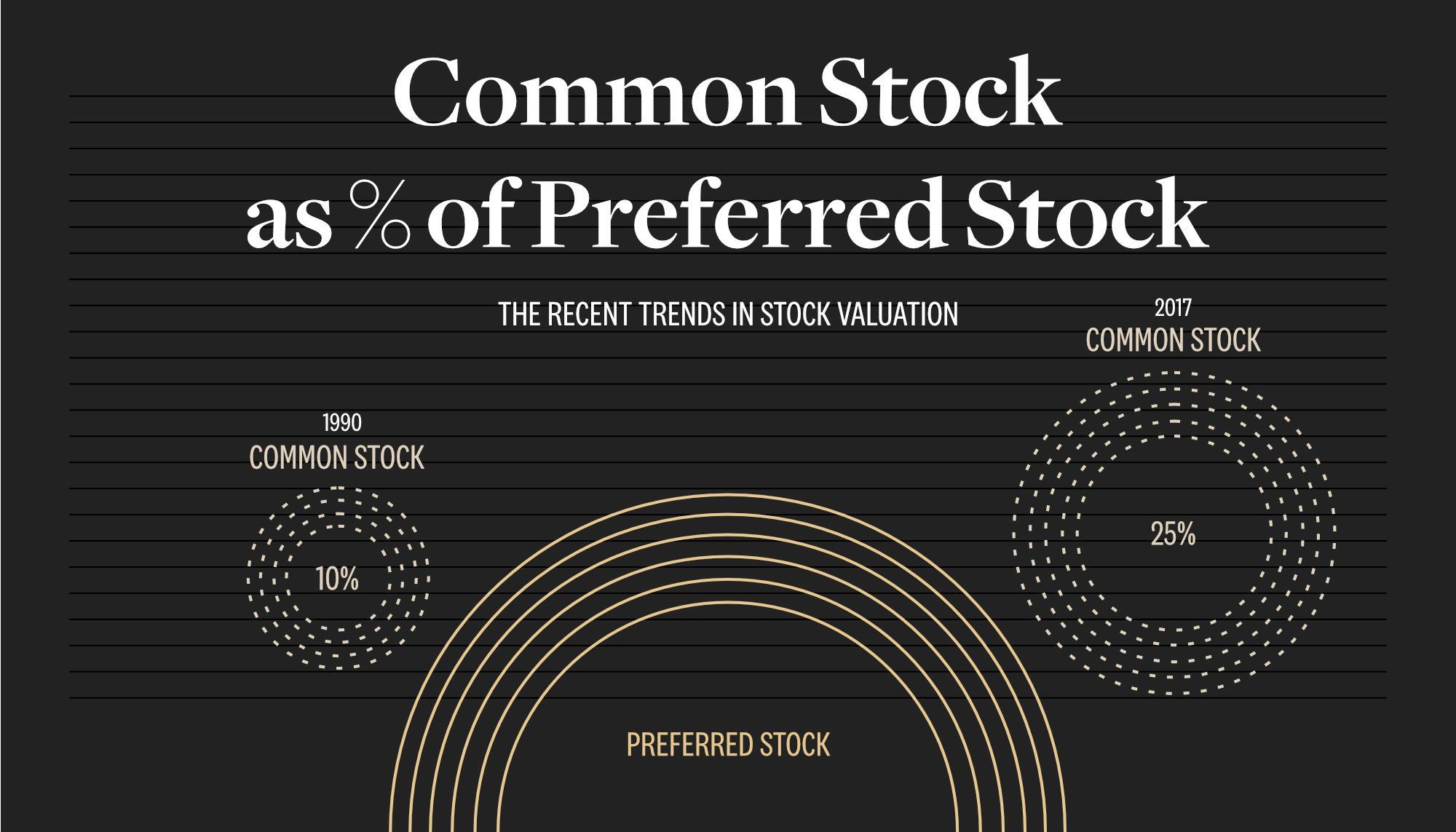

Preferred vs. common stocks

Popular stocks and preferred stocks are the two most common types of stock.

Common stock is, as the name says, the most common form of stock. The dividends and voting rights of common stockholders are regularly distributed every quarter. These payouts, however, are not stable and are not assured.

Preferred stock is a type of stock that offers a larger fixed dividend than common stock but has a lower potential for price appreciation. In the event of bankruptcy, preferred stockholders are still paid their dividends before common stockholders.

A professor of finance at Creighton University, Robert Johnson, argues, “If you buy 100 shares of Coca-Cola Company stock, you’re most likely buying the common stock.” “Common stock,” used by most businesses, makes up the vast majority of shares issued.

Common stockholders “elect the board of directors and vote on business issues,” says Webull CEO Anthony Denier. The disadvantage is that common shareholders have the lowest priority in acquiring firm assets in the event of bankruptcy.

Denier argues that preferred stock’s dividends are “stable” and that its yields are “greater than the same company’s ordinary stock distributions.” In addition, he mentions that “preferred shareholders receive their dividends before common shareholders” if the corporation is experiencing a liquidity crunch.

Stocks in Class A and Class B

Sometimes businesses will offer two types of stock, Class A and Class B. Class B shares often have higher voting rights than A shares, which is the main distinction between the two.

Investors in Coke’s common stock get one vote per share, whereas Class B investors get twenty. Companies often separate shares into classes like these to ensure that a select set of shareholders retains veto rights.

Different types and divisions of stocks

Let’s pretend you have no options beyond common stock as an investor. Searches for stocks can be narrowed down in many ways, including by size, sector, aesthetic preference, and geographic region.

Market capitalization is one measure of a company’s size on the stock market. Those looking to invest their money might prefer to stick to major, established corporations. Some investors may seek out the higher volatility of small and mid-cap stocks because of the potential for substantial rewards they provide.

Businesses may also be categorized in terms of the industries they serve. Sectors such as technology, manufacturing, finance, and consumer staples are just a few examples. The diversification of your stock portfolio can increase by purchasing shares in companies across several sectors.

Stocks that adhere to a certain investment style, such as growth, value, or dividend investing, are sought out by those employing this method. To cap it all off, stocks can be broken down geographically. U.S. investors, for instance, would desire to diversify their holdings away from the domestic market by purchasing shares of foreign corporations.

Profitable stock market investing strategies

Investment returns can grow at an exponential rate when compounded annually over a long period of time. Therefore, it is more likely that your success will depend on how long you have been active in the market than on how well-timed your entry was.

According to Johnson, “time is the investor’s greatest ally because of the magic of compound interest.” Thus, Johnson suggests that people “begin investing in a low-fee, diversified equities index fund and continue to invest consistently whether the market is up, down, or sideways.”

Investors should be aware of the substantial short-term risk of stock investing because the market has seen intra-year setbacks of 10%+ 10 times in the last 20 years, as the Schwab Center for Financial Research reported. Yet, it posted a profit in all but three of those years.

Conclusion

One’s return on investment in stocks is typically tied to the success of the firm whose shares they own. Stock market investments are a popular means by which individuals and institutions can accumulate wealth.

Nonetheless, assurances cannot be made. Investors in a publicly traded corporation’s stock usually lose money when the company goes bankrupt. However, the probability of suffering a severe loss due to a single bad stock decision decreases in proportion to the number of stocks in a person’s portfolio.

Thankfully, a large initial deposit is not required to open a brokerage account and begin constructing a diverse stock portfolio. You can buy into dozens or hundreds of equities with a small amount of money by using exchange-traded funds, mutual funds, or fractional shares.